philadelphia wage tax work from home

For those who used to commute to work in Philadelphia there is yet another benefit to working from home besides saving time gas and tolls. Upload W2 1099 and Wage Tax Refund Request.

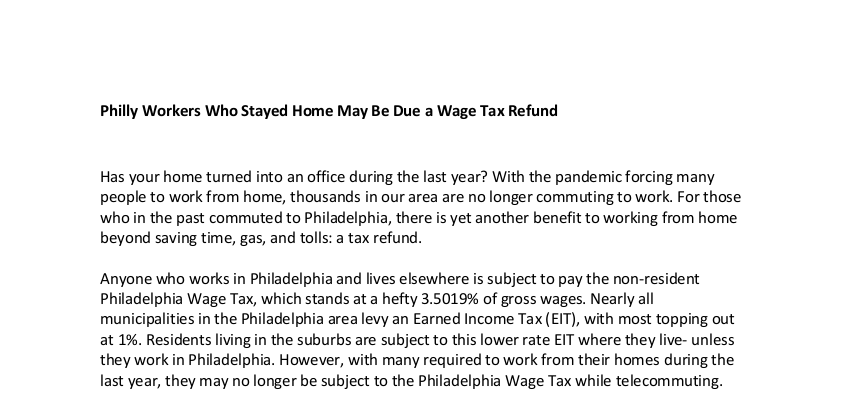

Philly Workers Who Stayed Home May Be Due A Wage Tax Refund Upper Southampton Township

Heres everything you need to know about it.

. The refund is allowable only for periods during which a non-resident employee was required to work outside of Philadelphia either pursuant to City ordinance or employer policy. Phillys wage tax is the highest in the nation. Do you still work for a Philadelphia company from your home outside the city.

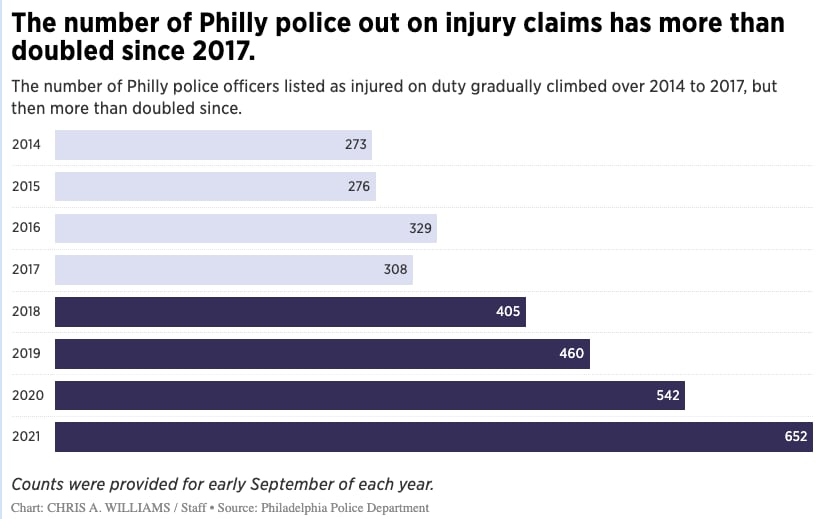

Thursday January 28 2021 PHILADELPHIA WPVI -- So many people are working from home during the pandemic and that could impact your taxes. Post-COVID Employment Tax Considerations. The Philadelphia Department of Revenue is providing 2020 City Wage Tax refunds to non-city residents required to work from home due to the pandemic.

Everyone who lives in Philadelphia is subject to the City Wage Tax regardless of where they work. Anyone who works in Philadelphia and lives elsewhere is subject to pay the non-resident Philadelphia. For those who in the past commuted to Philadelphia there is yet another benefit to working from home beyond saving time gas and tolls.

April 8 2021 The Philadelphia Department of Revenue is providing 2020 City Wage Tax refunds to non-city residents required to work from home due to the pandemic. With the pandemic forcing many people to work from home thousands in our area are no longer commuting to work. Online forms went live on Thursday and.

On the other hand if a Philadelphia employer requires a non-resident to perform duties outside the city he or she is exempt from the Wage Tax for the days spent fulfilling that work. In addition non-residents who work in Philadelphia are required to pay the Wage Tax. Those same non-resident workers are exempt from the tax when their employer requires them to work outside of.

Working remotely has its perks and its challenges so many. The Department has traditionally employed a convenience of the employer rule under which nonresident employees who are based in Philadelphia are subject to Wage Tax unless they are working remotely for the convenience of their employer eg a nonresident employee who works at home one day per week for personal reasons is subject to Wage Tax. In December 2019 a non-resident employee elected to defer 5 of her 2020 compensation.

Tom Wolf you do not have to keep paying the city wage tax. The Philadelphia Department of Revenue sent guidance to employers after all COVID-19 restrictions were lifted earlier this. Subject to Wage Tax to the extent they are required to work from home.

The Use and Occupancy Tax rate is 121 of the assessed value of a property with a 2000 annual tax exemption. If a Philadelphia employers office is officially open but employees have the option to work from home at their convenience all employees would be subject to the Philadelphia wage tax as if they were still working in the Philadelphia office. Normally Philadelphia non-residents employed in the.

If you live outside the city and have been working from home because your company closed its Philadelphia offices under orders from Mayor Jim Kenney and Gov. The City Department of Revenue also announced that employees working remotely from home in Philadelphia will be sufficient to give rise to business income and receipts tax nexus and must be taken into account when. But if companies close Philadelphia offices or downsize and require workers to rotate in on assigned days nonresidents will not pay the wage tax when working remotely.

The wages of the remaining non-resident employees that are not within such categories are subject to Wage Tax only on the days that they report to the Philadelphia work location. PHILADELPHIA KYW Newsradio Now that many Philadelphia employers have re-opened their offices commuters can expect to begin paying the non-resident wage tax again even if they are still working from their home outside of the city. Philadelphia levies a 34481 wage tax on people who work but dont live in the city.

Those FAQs clarified that when workers work from home because of an employer policy that materially limits their ability to come into the office nonresident employees are only subject to Wage Tax for the days spend actually working in Philadelphia. Upon becoming an employer of any of the following in Pennsylvania all employers must register with the City of Philadelphia within 30 days of becoming such an. PHILADELPHIA WPVI -- Millions of Americans have been working from home during the pandemic and that could impact your 2020 tax bill.

Those FAQs clarified that when workers work from home because of an employer policy that materially limits their ability to come into the office nonresident employees are only subject to Wage Tax. Nonresidents who work from home for their own convenience rather than the need of the employer are not exempt from the Wage Tax even with their employers authorization. Beginning July 1 2015 an exemption of 165300 applies to the assessed value of each property used for business.

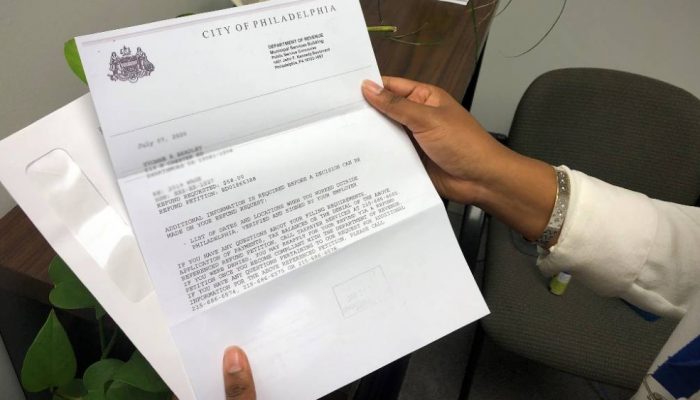

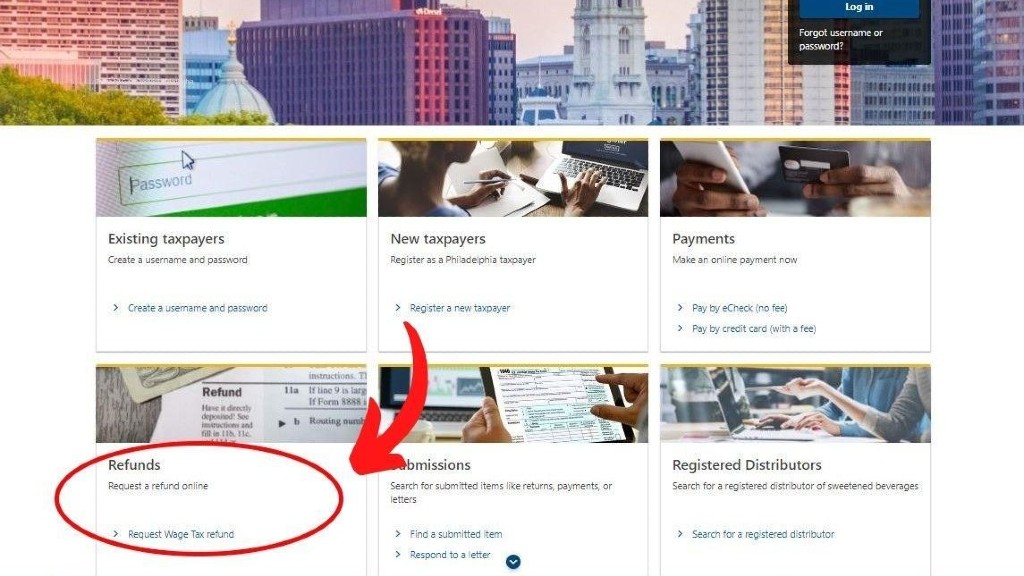

The refund is allowable only for periods during which a non-resident employee was required to work outside of Philadelphia either pursuant to City ordinance or employer policy. The wages of the nonresident employees of both A and B teams are subject to Wage Tax only for the weeks they are working at the Philadelphia location. Load Error Heres a step-by-step guide to requesting a city wage tax refund.

On the other hand if Philadelphia employers require nonresidents to perform duties outside the city they are exempt from the Wage Tax for the days spent fulfilling that work. As pandemic-related restrictions are being lifted in Philadelphia the Citys Wage Tax rules will apply to remote work arrangements. Due to social distancing rules an employer has a policy that only 20 of its workforce may work at the Philadelphia location on a given day and the remaining 80 must work from home.

A non-resident employee who works from home for his or her convenience is not exempt from the Wage Tax even with his or her employers authorization. If companies allow employees to telecommute after pandemic restrictions are lifted workers must pay the wage tax regardless of whether they work from home or not. Anyone who works in Philadelphia and lives in Middletown Township is subject to pay the non-resident Philadelphia Wage Tax which stands at a hefty 34481 as of July 1 2021 of gross wages.

How To Get Your Philly Wage Tax Refund Morning Newsletter

2021 Pa Act 32 Taxation Updates Support Center

Suburban Workers Reprieve From City Wage Tax Is Ending

The 10 Most Affordable States In America States In America Map Best Places To Retire

Why Was My Refund Request Denied Answers To Frequent Wage Tax Questions Department Of Revenue City Of Philadelphia

Reform Jersey Reformjersey Twitter

Philly Workers Who Stayed Home May Be Due A Wage Tax Refund Newtown Township Bucks County Pennsylvania

Philadelphia Refunds Millions In Wage Taxes To Suburban Commuters

![]()

Philadelphia Wage Tax Refunds Reboot For 2021

Philadelphia Wage And Earnings Taxes Decrease On July 1 Department Of Revenue City Of Philadelphia

Hourly Wage Then Log Download Pay Stub Template Word Free With Regard To Pay Stub Template Word Document Cumed O Word Free Templates Microsoft Word Templates

Careers Broadstep In 2021 Career Lockscreen Screenshot Lockscreen

Job Board Pnp Staffing Group Job Board Staffing Agency Non Profit Jobs

Request 2021 Wage Tax Refunds Online Department Of Revenue City Of Philadelphia

Philly Workers Who Stayed Home May Be Due A Wage Tax Refund Newtown Township Bucks County Pennsylvania

All For One One For All Home Co Purchasing Provides Ownership Option Home Buying Million Dollar Homes 30 Year Mortgage

Wage Tax Refunds And Payment Plans Made Easy Department Of Revenue City Of Philadelphia